목차

- Economic Overview of the United States: Current Trends and Projections

- South Korea’s Economic Situation: Challenges and Opportunities

- Interconnection of US and South Korean Economies: A Catalyst for Change

- Stock Market Reactions: US Economic Changes and Korean Market Response

- Global Economic Environment: Implications for Korean Investors

- Future Outlook: Navigating Economic Challenges

In this article, we delve into the recent economic trends in the United States and South Korea. We will explore how these developments influence each other, as well as their effects on the stock market. Key insights into the global economic landscape will also be discussed.

Economic Overview of the United States: Current Trends and Projections

The recent economic indicators in the United States reveal a complex landscape marked by moderate growth rates, fluctuating employment figures, and persistent inflation challenges. As of early 2023, the GDP growth rate showed promising signs of recovery, although it remains sensitive to external factors, including geopolitical tensions and supply chain disruptions. The employment sector is witnessing gradual improvements, with the unemployment rate hovering around historic lows, reflecting the Federal Reserve’s efforts to stimulate job creation.

Inflation, however, continues to be a significant concern, despite a recent slowdown attributed to easing supply chain bottlenecks and declining energy prices. Core inflation remains above the Federal Reserve’s 2% target, leading to ongoing monetary policy adjustments aimed at curbing inflationary pressures while balancing the need for continued economic growth. In response, the Federal Reserve has adopted a more cautious stance on interest rate hikes, signaling its commitment to achieving stable prices without undermining the recovery in job markets.

These dynamics shape the broader economic outlook, impacting not only domestic policy but also international relations, including trade ties and investment strategies. The interconnectedness of the U.S. economy with global markets means that trends in employment and inflation here will resonate in foreign economies, including South Korea’s, highlighting the importance of vigilance in monitoring these indicators.

South Korea’s Economic Situation: Challenges and Opportunities

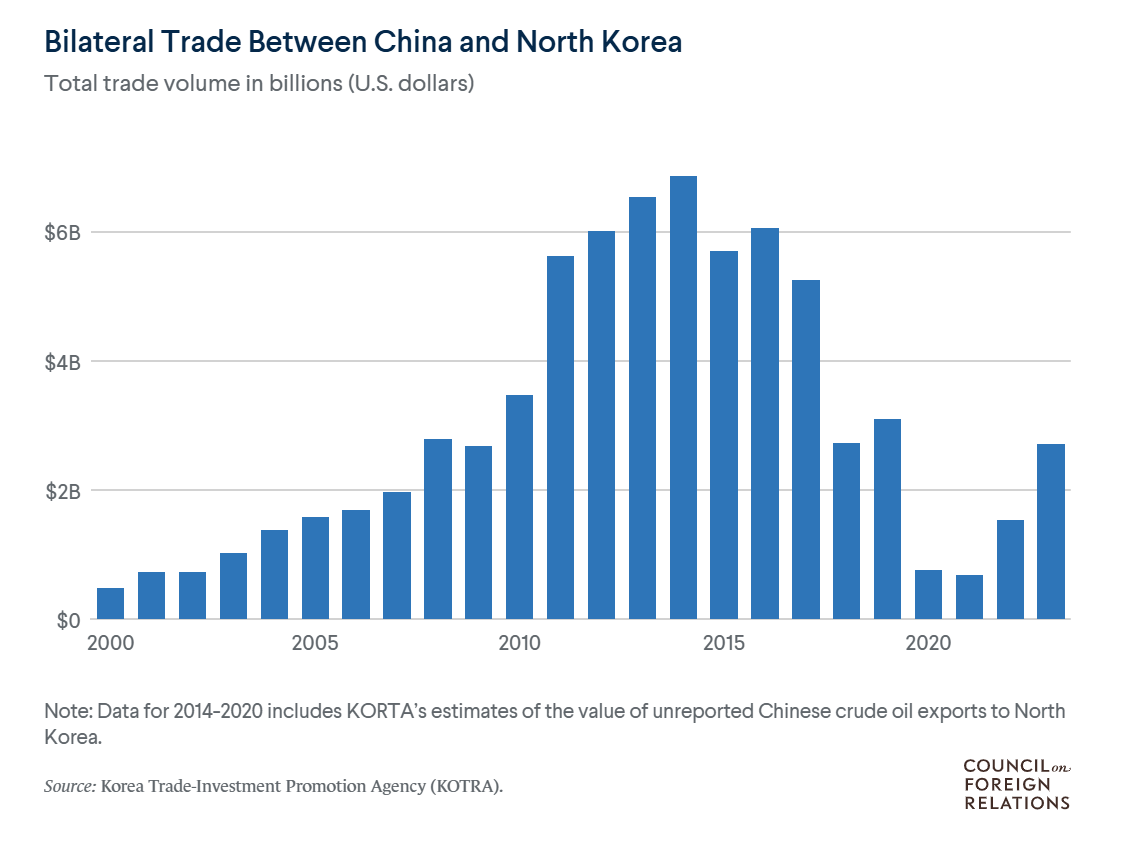

South Korea’s economy is currently navigating a complex landscape marked by both challenges and opportunities. In 2023, the nation’s GDP growth is projected at 1.4%, a modest recovery following years of slower expansion due to external economic pressures such as global demand fluctuations and rising inflation. Key industries underpinning this growth include technology, automotive, and exports, particularly to China, which is regaining momentum as COVID-19 restrictions ease.

However, South Korea faces significant hurdles, including an aging population, which is projected to reduce the country’s potential growth rate over the coming decades. In response to these challenges, the government is implementing strategies focused on innovation and digital transformation, aiming to bolster productivity and enhance competitiveness in global markets. Investment in green technologies and support for startups are also integral to these efforts, positioning South Korea to capitalize on emerging trends while mitigating the effects of external economic headwinds.

Interconnection of US and South Korean Economies: A Catalyst for Change

The economic ties between the United States and South Korea are intricate and pivotal, forming a foundational relationship that influences both nations’ economic landscapes. The U.S. is South Korea’s second-largest trading partner, with the bilateral trade volume amounting to approximately $150 billion in recent years. This robust trade relationship is complemented by significant investment flows, where American companies have established a strong presence in South Korea, particularly in sectors such as technology, automotive, and consumer goods.

Fluctuations in the U.S. economy have direct ramifications for South Korea’s economic stability. For instance, economic slowdowns in the U.S. often lead to decreased demand for South Korean exports, affecting key industries like electronics and machinery. Conversely, a thriving U.S. economy tends to elevate South Korean exports as consumer confidence and spending increase.

Moreover, the KORUS FTA has facilitated smoother trade flows, reducing tariffs and eliminating trade barriers. This agreement has positioned South Korea as a crucial player in global supply chains, particularly as the U.S. pivots towards diversifying its trade partners amidst geopolitical tensions. As a result, South Korea’s economic policies are increasingly aligned with U.S. economic strategies, making the interdependence of these two economies a significant catalyst for change.

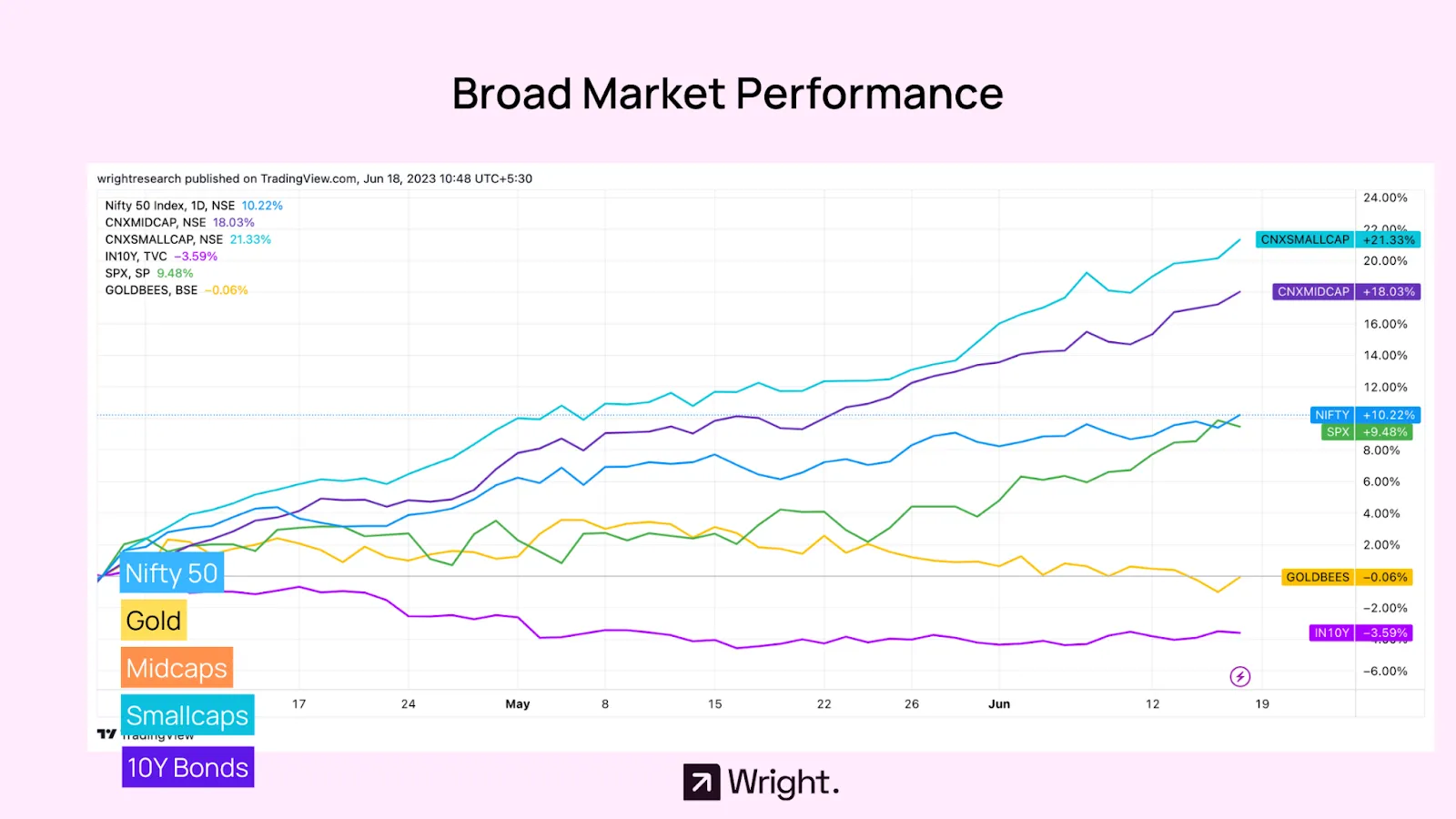

Stock Market Reactions: US Economic Changes and Korean Market Response

The dynamics of the US economy significantly influence the South Korean stock market, primarily through investor sentiment and global economic interconnectedness. Historical data suggests that when the US economy experiences growth, it often leads to increased foreign investment in South Korea, bolstering the Korea Composite Stock Price Index (KOSPI). However, economic downturns in the US can lead to rapid sell-offs in Korean stocks, as was the case in early 2023 when a decline in US employment figures triggered a sharp KOSPI drop by 8.77%. The correlation is heightened by the fact that foreign portfolio investments now constitute over 31% of KOSPI’s market capitalization, making the South Korean market particularly sensitive to US economic changes.

Moreover, shifting monetary policies in the US, particularly those concerning interest rates, reverberate through global markets, affecting Korean companies, especially in tech sectors. The reliance on exports makes Korea vulnerable, as disappointing US economic performance can reduce demand for Korean goods. Therefore, fostering investor confidence becomes paramount. Market trends indicate that proactive measures and adjustments in Korean fiscal policy can mitigate adverse impacts, emphasizing the need for strategic responses to ensure sustained growth amidst volatile US economic conditions.

Global Economic Environment: Implications for Korean Investors

The global economic environment significantly influences investment strategies for Korean investors, particularly in light of geopolitical events and evolving international trade agreements. As the United States continues to play a dominant role in the global economy, shifts in its policies, particularly regarding trade and tariffs, can have far-reaching implications for South Korea. For example, the recent tensions in U.S.-China relations have prompted a reevaluation of supply chains, compelling South Korean firms to adapt to new realities to remain competitive not only domestically but also in international markets.

Trade agreements, such as the U.S.-Korea Free Trade Agreement, also shape investment decisions. Enhancements to trade relationships can lead to increased market access and improved profitability for Korean companies, while challenges can necessitate a reassessment of market strategies. Moreover, currency fluctuations and interest rate changes driven by U.S. monetary policy can directly impact capital flows into South Korea, affecting stock market performance.

Understanding these dynamics allows investors to better navigate risks and seize opportunities in a rapidly changing global landscape. Active monitoring of geopolitical developments is essential, as is a strategic approach to diversifying portfolios to mitigate potential impacts from international market volatility. The interconnectedness of global economies means that South Korean investors must adopt a proactive stance, leveraging their expertise and responsiveness to thrive in this complex environment.

Future Outlook: Navigating Economic Challenges

In the face of evolving economic challenges, South Korea must strategically align itself with future trends in the US economy. As the US continues to navigate inflationary pressures and interest rate fluctuations, South Korea can benefit from a dual approach: enhancing bilateral trade relations and diversifying export markets. Strengthening partnerships in technology and green energy sectors can create new avenues for economic growth. Furthermore, leveraging the US’s economic recovery can reopen channels for South Korean goods and services, thus mitigating risks associated with dependence on single markets. By investing in workforce development and innovation, South Korea can adapt to shifting global demands while maintaining resilience against external shockwaves, ensuring long-term stability and growth.

This article has provided a comprehensive analysis of the intertwined economic conditions of the US and South Korea. By understanding these dynamics, stakeholders can better prepare for potential impacts on the stock market and broader economic landscape.

Recent Trends in South Korean Economy

US Economy,Korean Economy,Stock Market Trends,Global Economics,Economic Analysis,Financial Markets,Investment Strategies,